How to pass the Financial Accounting exam on your first attempt

Financial Accounting is a fundamental subject at the CPA Foundation level that introduces you to the recording, summarizing, and reporting of a business’s financial transactions. Mastery of this subject lays the groundwork for all advanced accounting papers.

What does the CPA Foundation Financial Accounting paper cover?

- The paper focuses on basic accounting principles and concepts.

- You learn how to prepare and interpret financial statements.

- It introduces the double-entry bookkeeping system.

- You will understand the accounting cycle, including journalizing, ledger posting, trial balance preparation, and preparation of adjustment entries.

- The paper also touches on accounting for assets, liabilities, equity, revenues, and expenses.

- Finally, you’ll learn the preparation of key financial statements: The Statement of Financial Position, Income Statement, and Statement of Cash Flows.

CPA Foundation Financial Accounting Syllabus / Key Topics

| Topic | Key areas to focus on |

|---|---|

| 1. Introduction to Accounting | o Nature and Purpose of Accounting. o The objective of Financial Accounting. o The Elements of Financial Statements. o The Accounting Equation. o The Users of Accounting Information. |

| 2.Accounting Process and Systems | o The Source documents, such as receipts and invoices. o The Books of Prime entry/Original Entry from the journals, cashbooks, Petty cashbooks, and registers. o The Ledger and the concept of double entry. o The Trial Balance and the Financial Statements. |

| 3. Regulation and other principles guiding the accounting profession | o The legal sources of regulation. o The professional sources of regulation (local and international bodies) and ethical requirements. o Accounting Standards. o Common accounting principles/concepts. o Qualities of useful financial information. |

| 4. Accounting for Assets and Liabilities | o Property, Plant and Equipment (depreciation, acquisition, disposal, exchange, excluding revaluations). o Intangible Assets. o Financial Assets and Financial Liabilities (Definition, Examples, and Classification only). o Inventory. o Cash in hand and cash at bank (bank reconciliation statements). o Trade Receivables (Measurement and Credit Losses). o Trade payables. o Accrued Incomes/Expenses and Prepaid Incomes/Expenses. |

| 5. Financial Statements of a sole trader | o Statement of Profit or Loss. o Statement of Financial Position. |

| 6. Financial Statements of a partnership. | o The partnership deed/agreement. o The statement of Profit or Loss and appropriation. o Partners’ capital and current accounts. o The statement of financial position. o Accounting treatment and presentation when there is a change in profit/loss sharing ratio, admission/retirement of a partner, dissolution of a partnership. |

| 7. Financial Statements of a company | o Important concepts of a company (Ordinary and Preference share capital, issuing new shares by way of full market price, bonus shares and rights issue, Reserves, retained profits and corporation tax). o Statement of Profit or Loss. o Other comprehensive incomes. o Statement of Financial Position. o Statement of Cash Flows. |

| 8. Financial Statements of a manufacturing entity | o Manufacturing Statement of production. o Statement of Profit or Loss. o Statement of Financial Position. |

| 9. Statements of a not-for-profit entity | o Objectives of Not-for-profit organizations. o Statement of Income and Expenditure. o Statement of Financial Position. |

| 10. Correction of errors and preparing financial statements with incomplete records | o Important concepts of a company (Ordinary and Preference share capital, issuing new shares by way of full market price, bonus shares and rights issue, Reserves, retained profits and corporation tax). o Statement of Profit or Loss. o Other comprehensive incomes. o Statement of Financial Position. o Statement of Cash Flows. |

| 11. Analyzing Financial Statements | o The objective of analyzing financial statements o Analyzing financial statements using financial ratios (Liquidity, Profitability, Solvency, Efficiency, Investor/Value, and Cash Flow categories). |

| 12. Accounting in the Public Sector | o Property, Plant and Equipment (depreciation, acquisition, disposal, exchange, excluding revaluations). o Intangible Assets. o Financial Assets and Financial Liabilities (Definition, Examples, and Classification only). o Inventory. o Cash in hand and cash at bank (bank reconciliation statements). o Trade Receivables (Measurement and Credit Losses). o Trade payables. o Accrued Incomes/Expenses and Prepaid Incomes/Expenses. |

Exam format and expectations

- The exam usually includes a combination of theoretical questions (definitions, explanations) and practical problems (journal entries, ledger accounts, financial statements).

- You will be expected to prepare complete financial statements from the given trial balances or adjusted trial balances.

- Bank reconciliation and error correction questions are commonly tested.

- Time management is crucial since the paper involves detailed calculations and statement preparation.

- Clear presentation of work and proper use of accounting terminology are essential.

Tips on how to pass the Financial Accounting exam on your first attempt

- Master the basics of double-entry bookkeeping: Practice journal entries and ledger postings repeatedly until confident.

- Understand and memorize key accounting principles and concepts: They are frequently tested in theory questions.

- Practice preparing trial balances and identifying errors: Ensure you can spot and correct different types of errors.

- Work on preparing financial statements from adjusted trial balances: This is a major part of the exam.

- Practice bank reconciliation problems: They test your understanding of cash management and error identification.

- Use past CPA Foundation exam papers and marking schemes: Familiarity with question style and examiner expectations will boost confidence.

- Develop good exam technique: Read all questions carefully, allocate time based on marks, and show workings neatly for partial credit.

- Use revision guides/kits and other recommended revision platforms and summary notes: These help in quick revision of formulas and definitions.

- Group study and discussion: These can help clarify difficult topics and improve understanding.

- Stay consistent and revise regularly: Don’t cram; steady preparation leads to better retention and exam performance.

Useful resources

- KASNEB official syllabus and past papers (available on the KASNEB website)

- CPA Foundation study texts by reputable authors/publishers.

- CPA Foundation revision guides/kits, revision notes.

- Online video tutorials, revision platforms, and accounting forums for interactive learning.

- Accounting practice software or Excel templates to simulate bookkeeping.

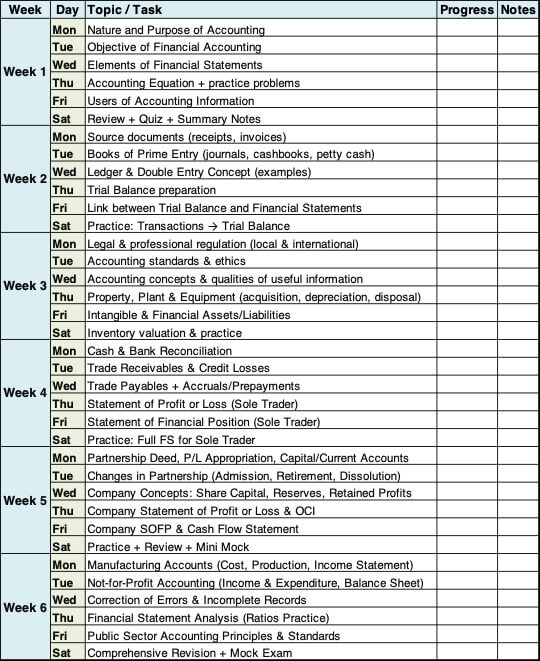

6-Week Study Plan| Financial Accounting Sample

Additional Tips

- Weekly Review: Dedicate Saturdays to reviewing and practicing questions from previous topics.

- Past Papers: Start practicing past CPA Foundation papers/revision kits by Week 4 onward.

- Flashcards: Make flashcards for accounting terms, concepts, and key ratios.

- Group Discussion: Join or form a study group once per week for challenging topics.

- Final Revision: Use Week 6’s Saturday for a timed mock exam covering all sections.

How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt, How to pass the financial accounting exam on your first attempt,